Блог им. st-travich |⚡️ New opportunities in Copper, Cocoa and NZD

- 18 июня 2023, 23:51

- |

Hello traders! My congratulations to you on Father's Day!

What happened in Crude Oil and natural gas that week? We will discuss in this short video.

And I want to make new forecasts in Copper (HG), Cocoa (CC), and New Zealand dollar (6N) according to new imbalances which happened that week.

Thank you very much for watching! And wish you a perfect week.

- комментировать

- Комментарии ( 0 )

Блог им. st-travich |Sugar, Mexican peso and RWC final

- 04 июня 2023, 17:26

- |

Hello traders, hope you are doing well 👍

Today I see two opportunities in Sugar (SB) and the Mexican Peso (6M). Let's start with the second one.

● The last strong involvement of sellers in this asset was on level 0,05546$. It matches with the commercial level also, where hedgers added more than 20% of short contracts in the past.

Market maker absorbed this position and apparently unloaded it along the way to break out of market highs. (Watch)

Now all the passengers are liquidated and we are ready to take bearish 🐻 movement when the ice line will be broken.

● According to Sugar (SB) vice-versa I see the buying opportunity. 🦬

After the involvement of sellers created by bid HFT volumes on the market bottom and after the divergence of Deltas. If the bearish parabola will be broken on Monday, hope to see the movement to the 26$ price zone. (Watch)

( Читать дальше )

Блог им. st-travich |So brave Bears 🐻 started in S&P 500 and lost everything by the end of the week

- 28 мая 2023, 16:59

- |

Hello dear traders!

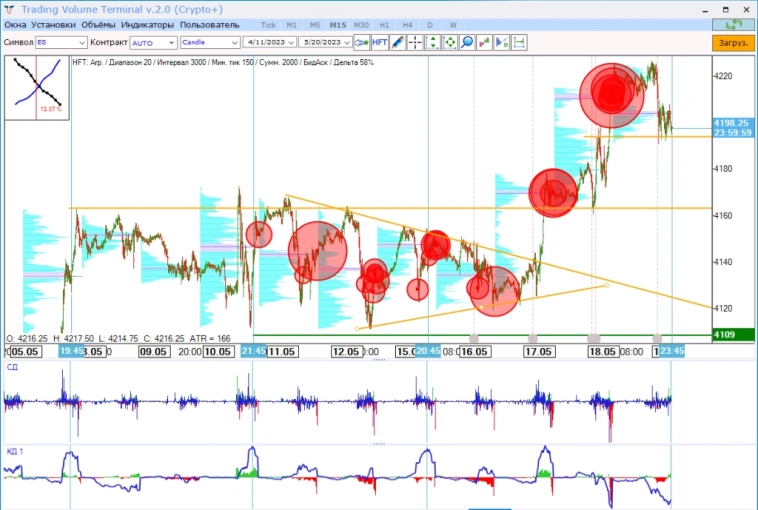

● So brave Bears 🐻 started in S&P 500 and lost everything by the end of the week

● What will be next? now it is difficult to predict.

Nasdaq made an impudent bullish workout of the support 👏

( Читать дальше )

Блог им. st-travich |The time has come! Sell in May and RUN away. 🏃♂️

- 21 мая 2023, 15:09

- |

Hello traders!

The time has come! Sell in May and RUN away. 🏃♂️

Today I want to give you a long-term forecast.

I have a Bearish view on all American Indices S&P500 (ES), Nasdaq (NQ), and Dow Jones (YM).

● I never saw such a big amount of Bid HFTs with no one ASK, even a little!!! 😱

● The market made a breakout of the important resistance level on the daily chart and all the Bear passengers are exhausted to wait falling

( Читать дальше )

Блог им. st-travich |⚡️ Today observed all the assets, but exceptionally don’t see potential understandable scenarios 🤷♂️ Everything went on Thursday and Friday.

- 14 мая 2023, 20:13

- |

Good evening, traders!

Today observed all the assets, but exceptionally don’t see potential understandable scenarios 🤷♂️ Everything went on Thursday and Friday.

🔹 British pound this week showed us how amazing involvement in buys looks like. (Watch)

How long does it take for the pattern to be created and how quickly should a decision be made on it, — only 15 minutes after the formation of HFT volumes. So fast reaction from the market makers limit orders.

Our mind is rather inert and in good situations, he especially begins to hesitate “Can we wait a little more, maybe a little more to see what will be around the corner?” As a result, the next 15-minute candle already changes the risk-reward ratio by 2 times! Not in our favor...

An excellent quote by Linda Raschke fits here: “In trading, as in fencing, there are either quick or dead.”

Markets operations are based more on psychology than on fundamentals, says El Weiss in Jack Schwager's book “The New Market Wizards”. “Markets are completely based on human psychology, and by charting markets, you are only converting human psychology into graphical form.”

( Читать дальше )

Блог им. st-travich |Flash in the pan 😕

- 18 сентября 2022, 17:07

- |

Flash in the pan 😕

Hello, traders

That week was really difficult and some of the forecasts were wrong. So today we will focus on analyzing mistakes and making conclusions.

This video is only 9 minutes, but still, I tried to make it informative and useful for you, please watch

( Читать дальше )

Блог им. st-travich |NEW buying opportunities in 6N, 6C, 6A and Corn

- 21 августа 2022, 18:03

- |

Good day, Traders, NEW video analysis is ready!

Today we will speak about Corn (ZC) and buying opportunities in the New Zealand dollar (6N), Canadian dollar (6C), and Australian dollar (6A).

Hope this information will be very helpful for you!

This time it’s a 10-minute video to watch

( Читать дальше )

Блог им. st-travich |😱 Historic hedgefunds short in Crude Oil!

- 14 августа 2022, 11:18

- |

Today we will observe what worked out from the previous video analysis and speak about Crude Oil.

Hedge funds never had such a strong short during the last 5 years and it can be a good opportunity for swings the next week!

Everything which is important we will discuss in this 8 minutes video.

( Читать дальше )

Блог им. st-travich |COT reports

- 25 апреля 2022, 23:03

- |

Let's overview and discuss potential scenarios for the futures market.

The previous week was very powerful for predictions, especially on gold, silver, and Mexican peso. Let's see and try to find what to do next.

( Читать дальше )

Блог им. st-travich |COT reports

- 19 апреля 2022, 22:36

- |

Hello Traders!

It was a volatile but not so good week, eventually for me. My expectations about US Treasury Bonds, the Australian dollar have not been realized and the Japanese Yen made a hard rock falling, without any correction, because of the very dovish monetary policy of the central bank compared with FED.

🔺 But still, Ultra US Treasury Bonds (UB) can show us buying opportunities on this level

It was my plan and I traded it, of course, the most important thing is to manage your risk, not to be suffered very much because of unexpected movements.

🔺 Even the Mexican peso (6M) returned to breakeven. Of course, I expect a further continuation, but it is not the proper picture.

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс